cinch - part-exchanging a car

Enabling customers to part exchange their current vehicle, with outstanding finance

cinch

An online used-car marketplace that allows customers to browse and buy a car entirely online.

The goal

To design a faff-free, delightful user experience that enables customers to settle their outstanding finance on their current car when they part-exchange this vehicle through cinch.

This comprised designing a functionality that enables customers to upload their settlement letter, which is an important document that specifies the total amount that is left to pay on their part-exchange, and details of the finance agreement.

Perceived Value - Customer Need

When I am looking to upgrade my car,

Help me to settle the remaining balance on my current car,

So that I'm not tied into my finance term.

Business Value

Indication that settling outstanding finance would increase purchase conversion.

Extrapolated data suggested that implementing this feature would result in a 37% increase in finance order volume.

Assumptions

Customers who would settle outstanding finance today order elsewhere.

Part-exchange settlement for digital sales is similar to brick-and-mortar sales.

Results from a Hotjar poll run in March 2021 suggest that 13.5% of survey respondents had outstanding finance, of which 48% would shop elsewhere because cinch do not currently settle finance. If we extrapolate this proportion to cinch volumes, this equates to approximately 60 sales per week.

Assumptions:

The Hotjar poll accurately reflects prospective customer base.

The Hotjar poll accurately represents total orders.

Constraints & considerations

cinch must sell a car as part of the transaction; this can be paid in full or paid with finance.

The transaction must be as faff-free as possible.

The customer-facing journey must be fully digital, except for calls with customer service agents, should any issues arise.

My role

Senior UX Designer. It was my responsibility to design the finance and settlement journey, from understanding the problem space and requirements, through to the final designs.

Approach

Collaboration, Workshops & Flows

Cross-functional collaboration from the start of the project - worked alongside product owners, business analysts, engineers, content designers and service designers.

Facilitated workshops with impacted squads to understand the requirements, constraints and any issues to be aware of and raised.

Worked closely with business analyst to produce flows and ensure all scenarios were captured.

Capturing what we already know

Scenarios and flows

Ideation

I ran ideation sessions to generate ideas and inspiration for what the journey might look like.

Background & context

Ideation

Exploration

Wireframes & designs

I produced and iterated on low fidelity wireframes that were regularly shared and reviewed with squads, to capture feedback and validate screens.

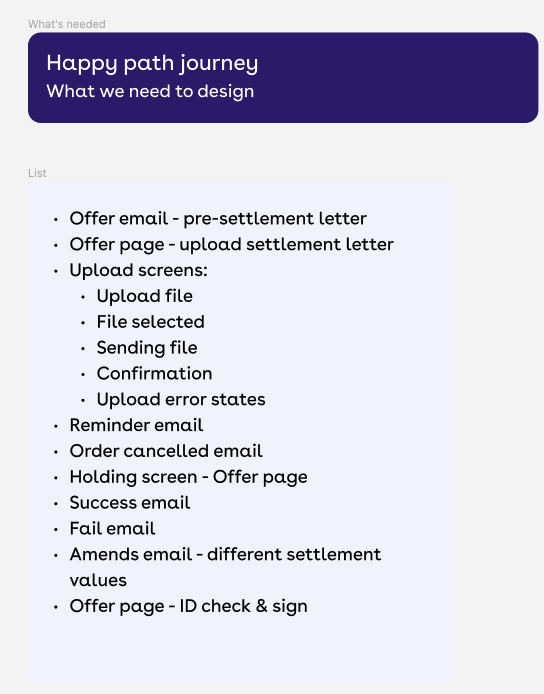

Initially began with the ‘happy path’.

Followed by the ‘unhappy paths’ and error scenarios, which were designed up-front, to minimise friction. In particular, I focused on the following:

Upload errors

Invalid settlement letter email

Amended offer email

Happy Path wireframes & journey

Upload error states

Invalid settlement letter email

Amended offer email

Content design & Compliance

Content and UX design exploration - worked closely with content designer to ensure the flow of information across the journey was consistent, complex financial content was simplified and easy to understand, and hierarchy of content was optimised, given space restrictions.

Ensured all content and designs were reviewed and approved by Compliance and Legal teams before progressing.

Compliance caveats were added after learning that 16% of users had submitted incorrect settlement values.

Content design collaboration

User needs and questions

Compliance caveats

Designs & Reviews

Produced UI designs for all screens, variants and all scenarios.

Re-used design patterns, e.g. a tooltip to simplify the part-exchange calculation that is presented to customers

Ran regular design reviews with the wider team (all disciplines/functions) to share progress and gather feedback - these were carried out in sessions and asynchronously to capture all feedback. Designs were iterated based on feedback.

Work was regularly presented, and progress updates shared, at weekly ‘stakeholder round table’ sessions.

User Research

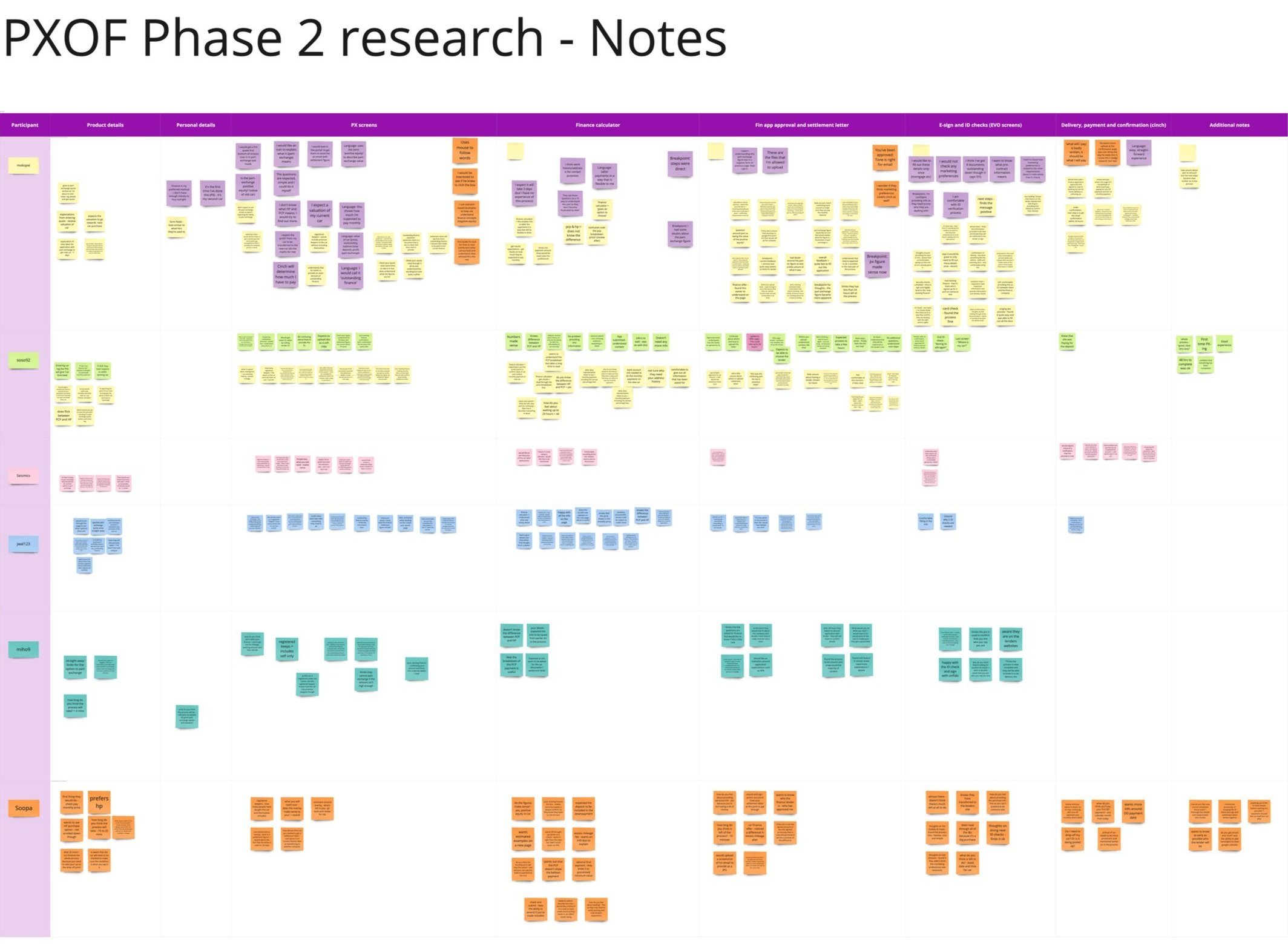

Produced a prototype for the full finance journey, to provide context for participants

6 x 1hr moderated interviews through UserTesting, to gain insights on the designs, content and process.

Objectives

Do people understand the process overall?

Is it clear what information they need to provide, when and how?

Is the overall content clear?

Any major blockers or showstoppers?

Summary

No major blockers or showstoppers

Offer email and page were useful and clear

Consider explaining some of the reasons why figures may have changed from original quote to help ease the frustration of seeing higher monthly costs or APR

Upload letter journey was clear

Recommend adding settlement letter format info earlier in the journey

Inconsistent terminology and confusion around some financial figures, specifically; part-exchange value, part-exchange quote and deposit

How can we better set expectations at the start of the process about what's involved, and at the end of each stage around what's left to do, to encourage customers to push through?

Prototype - Full Finance journey

User Research - notes & insights at each stage of the journey

Outcomes

The new process went live in April 2022, allowing customers to purchase a vehicle with the option to either pay in full or pay with finance, and part-exchange their vehicle that has outstanding finance, to use as a deposit.

In order to mitigate the risk of customers dropping out of the journey at the finance application and offer stages, it was essential to provide users with clear, timely messaging and sign-posting, at the start of the journey as well as at the point where users are asked to enter their settlement value.

Part-exchange - Upload settlement letter designs

Personal achievements

This was a complex finance project, with many moving parts and scenarios to design for within tight timelines.

It was great to work across different squads and functions - a real collaborative effort.

This functionality was a key offering for the business, with the potential to bring significant revenue gains.